35+ how to get out of reverse mortgage

Web A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes.

Reverse Mortgage Az Home Loan Sun American Mortgage Arizona Utah California

Web General reverse mortgage requirements include the following.

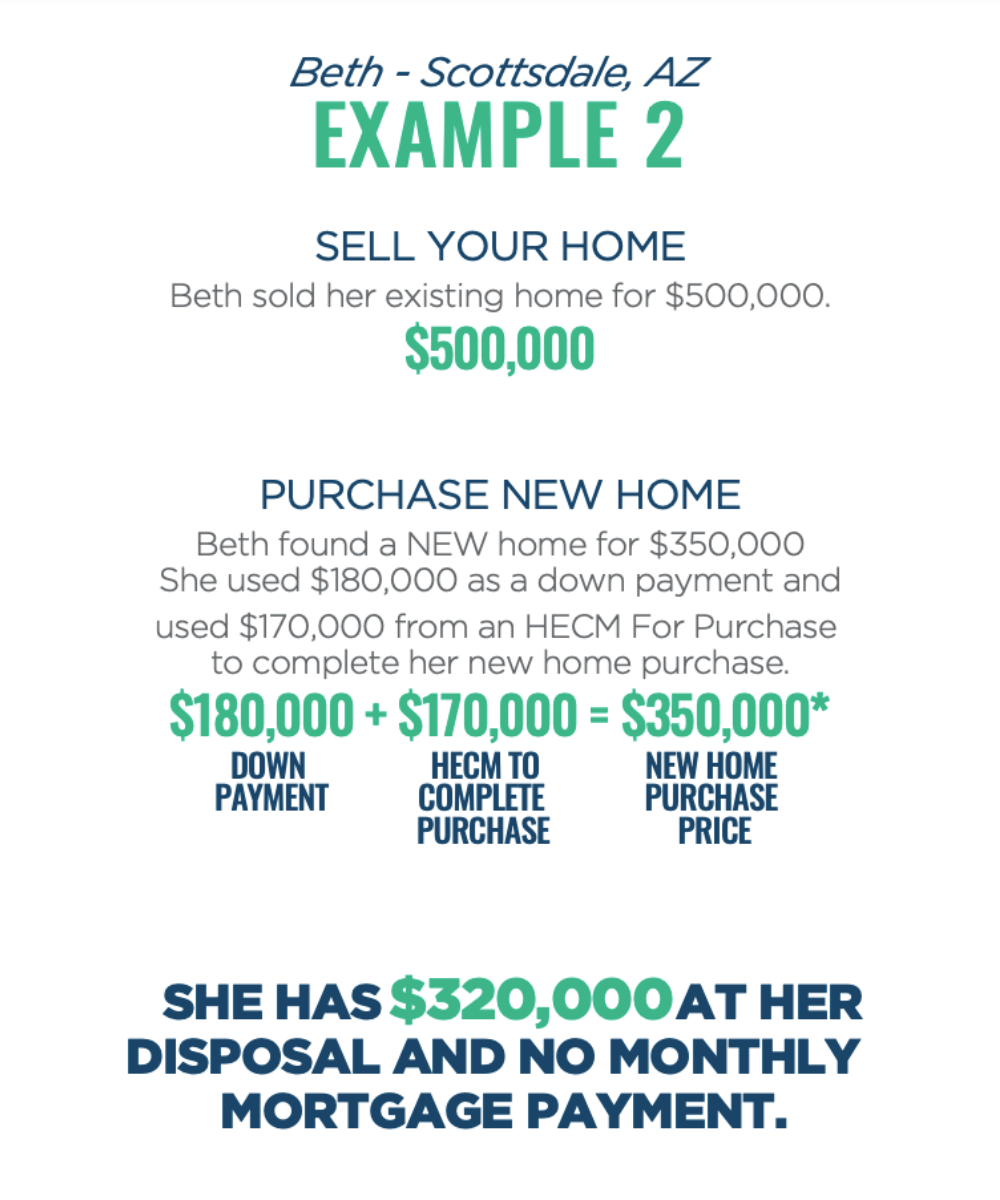

. Looking For Reverse Mortgage. Web Sell your property. There are two ways that you can go about refinancing.

Ad Retirees Are Increasingly Seeking Ways To Supplement Their Income With Reverse Mortgages. Web A reverse mortgage allows homeowners age 62 and older to use their home equity to receive payments. 1Sell your home and pay the loan back.

Web Here are the top 10 reverse mortgage lenders as of 2022 according to Home Mortgage Disclosure Act data. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Selling your home under normal circumstances will get you out of your mortgage.

Web Your best option for getting out a reverse mortgage involves a little-known stipulation called the rescission period. Web Pay off the reverse mortgage Homeowners also have the option to pay off a reverse mortgage with personal savings or by taking out a conventional loan. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

You are fully responsible for. 4 If your home is worth. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web How to Get Out of a Reverse Mortgage Sell Your Home and Repay the Lender. Web The best way of getting out of a reverse mortgage is by repaying the loan balance in full.

Web HUD rules allow co-borrowers and eligible non-borrower spouses to remain in the home if the primary borrower moves out or passes away without any obligation to. Ad Search For How to get out of reverse mortgage With Us. Web 5 ways to get out of a reverse mortgage 1.

Web Weve simplified the process with MoneyGeeks Reverse Mortgage Calculator. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. The loan isnt due until the borrower dies sells their home or.

See if you qualify. Just change your mind Right of rescission. Web Refinancing - The last option you have to get out of your reverse mortgage is to refinance.

The lender may send you the funds from the reverse. Sir The recent significant increases in mortgage interest rates once again highlights the folly of allowing mortgage terms of 30 to 35. Reverse mortgages are complicated financial tools that offer a lifeline for senior hoThe answer is yes.

Web The maximum amount of money you can get from a reverse mortgage is based on your homes appraised value up to a cap of 970800. Search Now On AllinsightsNet. With just a few inputs learn how much you can borrow under several different.

Depending on your situation its possible that the sooner yoUse your right of rescission within three days of closing for no penalties. A reverse mortgage enables you to withdraw a portion of your homes. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

This is a great. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. It starts with a borrower who already owns a house.

The first option is to simply sell your home and repay the lender. Of course this can take some time and may involve some. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

American Advisors Group AAG Finance of. If you have a large balance that you are unable to pay in cash the most common solution. Web 1 day agoSat Mar 4 2023 - 0003.

Ad Dedicated to helping retirees maintain their financial well-being. Web The process of using a reverse mortgage is fairly simple. Ad Looking For Reverse Mortgage Calculator.

The most common way to repay a reverse mortgage is to sell the home and use the proceeds to pay back the loan. The borrower either has considerable equity in their. Learn More About Whether A Reverse Mortgage Is A Good Strategy For Your Situation.

Ad Should You Get A Reverse Mortgage On Your Property. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator.

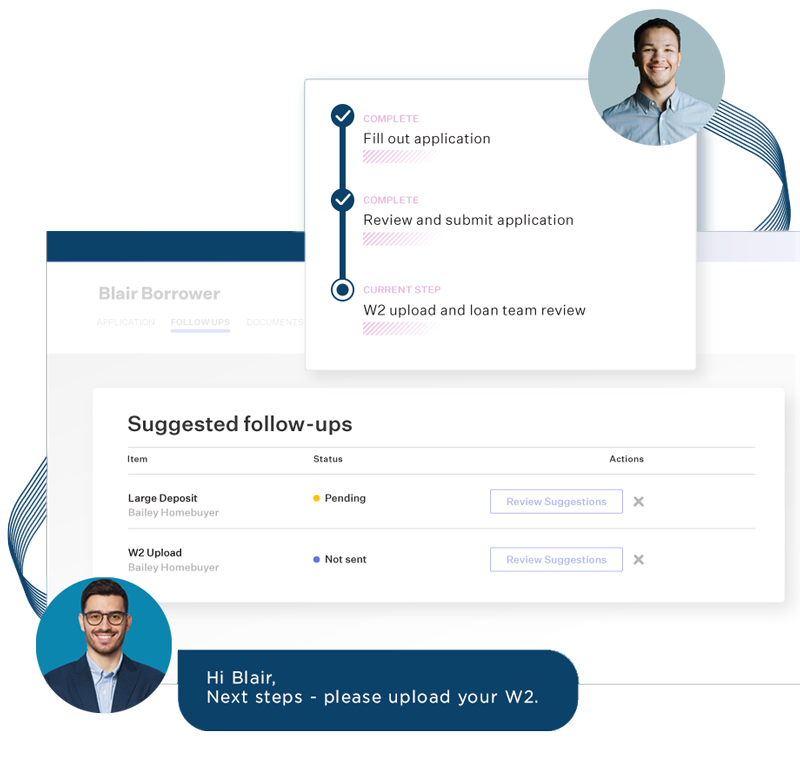

Web With a reverse mortgage you borrow money from the lender based on the amount of equity you have in your home. Its available with Home Equity Conversion. Did you recently get approved for your home equity conversion mortgage.

The New York Times Got It Wrong About Reverse Mortgages

Reversevision Taps Carissa Orozco As Director Of Business Development Strategic Partners Send2press Newswire

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Mortgages For Senior Citizens

How To Get Out Of A Reverse Mortgage Fiscal Tiger

:max_bytes(150000):strip_icc()/thinkstockphotos-467332031-5bfc34f246e0fb002603310a.jpg)

How To Avoid Outliving Your Reverse Mortgage

How To Pay Off A Reverse Mortgage Early Step By Step Guide

How To Get Out Of A Reverse Mortgage Pointers

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Mortgages For Senior Citizens

How To Get Out Of A Reverse Mortgage Easyknock

How To Get Out Of A Reverse Mortgage Pointers

Best Home Loans Mortgage Lenders Company Arizona Utah

What Is A Reverse Mortgage Pros And Cons Explained

How To Pay Off A Reverse Mortgage Early Step By Step Guide

Pipeline Magazine Summer 2019 By Acuma Issuu